Banking and financial service leaders face insurmountable business challenges that often require care, attention, nuanced thought, and insightful decision making. Data analytics can assist to tackle any business decision that requires prudent action. Whether trying to answer questions, detect trends, allocate capital, or extract insights, without proper data analytics, any decision maker is flying blind.

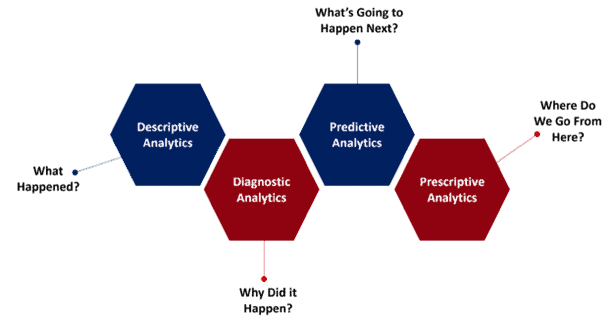

There are four main types of Data Analytics when it comes to decision making1:

1. Descriptive Analytics

Descriptive Analytics is the most rudimentary of analytics and serves as the basis for all the other types. It is used to extract trends from raw data and answer the question of what happened or what is ongoing.

2. Diagnostic Analytics

Diagnostic Analytics examines the “why” question and is important when examining correlation and causation. Correlation does not necessarily equal causation. Just because an event occurs at the same time or immediately after another does not mean one has found the root of the problem.

3. Predictive Analytics

Predictive analytics helps predict future trends. This is where most modelers, speculators, economists, and investors place most of their interest. Guessing the direction of a target market or what the next big trend will be is the hardest question in any industry to answer. While no one organization can accurately predict the future with 100% certainty, organizations that can better interpret the data and develop business insights have a competitive advantage.

4. Prescriptive Analytics

Finally, prescriptive analytics answers the question of “Where do we go from here?”

This form of analytics is scenario-based. If an organization were to consider all possible scenarios , evaluate possible outcomes and react accordingly. Prescriptive Analytics delivers the benefits from other analytics types and builds upon them. This is the answer to the sixty-four-thousand-dollar question, and if one’s predilections are minimized, the analysis, assumptions, and scenario-based outcomes are accurate, an organization will find itself in the enviable position of gaining market share.

The use of alternative data in data-driven analytics helps develop insights into the probability of a future occurrence.

A recent example of this is an application or implementation at Armed Forces Bank2. At first look, Armed Forces Bank’s Access Loan appears to be like any other personal loan product provided to military members and their families by community banks and credit unions. However, the product’s underwriting is what distinguishes it from its competitors. The $1.2 billion-asset lender uses alternative credit data such as rent, utility, and telecom payments, which is a typical for a bank of its size. Lenders with $50 billion or more in assets are less likely to use alternative credit data. Even among community banks that employ alternative data, few do so to the extent that Armed Forces has. The Kansas-based bank built this proprietary system to underwrite its loans. This opens the market for not only traditional loan making, but also any potential cross selling opportunities that may have previously escaped a banker’s grasp.

Another case of using alternative data is Geomarketing, which is considered the “next frontier” of customer engagement. This is done by making use of two techniques called Geofencing and Geotargeting. Geofencing is setting up a parameter around a particular location and Geotargeting is serving ads and messages to those who enter that arena. For example, a retail bank can set up a digital location surrounding a popular cash only restaurant, favorited by its consumers. When one of their clients enters the Geofence, they will receive a targeted message alerting them that the restaurant they are in is cash only and informing them that there is an ATM in the area that will not incur a fee for making a withdrawal. With the proliferation of smartphones and digital footprints left by consumers, digital marketers can use Geo-augmented data to reach a receptive audience.

While alternative data has been successfully used in many revenue generation applications, it can also play a key role in risk mitigation. JPMorgan Asset Management has been using forensic data to supplement the Environmental, Social, and Governance (ESG) metrics. According to Financial News3, this includes working with an external vendor to test soil samples to confirm 100% organic cotton supplies come from their original farm and not a secondary location. While ESG data is an important sustainable investing input, leveraging forensic data from external data can help decision makers avoid unwanted reputation risk.

Banking and financial institutions continue to manage billions of terabytes in structured and unstructured data. Leveraging the power of data analytics to make well-informed, real-time, and revenue driven business decisions is key to the competitiveness of an organization. Understanding how and when the types of data analytics can be used to benefit both clientele and empower the front office is unequivocally the future of banking.

Sources:

1Cote, C. (2021, October 19). 4 types of data analytics to improve decision-making. Business Insights Blog. Retrieved April 21, 2022, from https://online.hbs.edu/blog/post/types-of-data-analysis

2Reosti, J. (2021, November 1). Armed Forces Bank Taps Alternative Data to lend to new recruits. American Banker. Retrieved April 21, 2022, from https://www.americanbanker.com/news/armed-forces-bank-taps-alternative-data-to-lend-to-new-recruits” https://www.americanbanker.com/news/armed-forces-bank-taps-alternative-data-to-lend-to-new-recruits

3Ricketts, D. (2022, February 10). JPMorgan Asset Management taps forensic science for ESG data to expose Supply Chain Risks. Financial News. Retrieved June 1, 2022, from https://www.fnlondon.com/articles/jpmorgan-asset-management-taps-forensic-science-for-esg-data-to-expose-supply-chain-risks-20220210

About BIP.Monticello

BIP.Monticello Consulting Group is a global management consulting firm supporting the financial services industry through deep knowledge and expertise in digital transformation, change management, and financial services advisory. Our understanding of the competitive forces reshaping business models in capital markets and digital banking are proven enablers that help our clients drive innovative change programs to be more competitive and gain market share in new and existing businesses.