Significance of Artificial Intelligence in the Banking Industry Today

Artificial Intelligence (AI) is revolutionizing customer service in the banking industry and transforming how companies operate and interact with their customers, especially within the banking sector. AI-powered solutions allow companies to deliver personalized, efficient, and accurate service to their customers, ultimately leading to higher levels of customer satisfaction and loyalty. Through the use of chatbots, machine-learning algorithms, voice recognition technologies, and other advanced AI technologies, companies are enhancing their customer service capabilities in ways that were once unimaginable.

How Artificial Intelligence is Improving Customer Service in Financial Services

In the financial services industry, banks and other organizations are expected to take advantage of AI to make their customers’ lives more time-efficient and easier. Here are some ways that AI can improve customer service:

1) Use of Chatbots

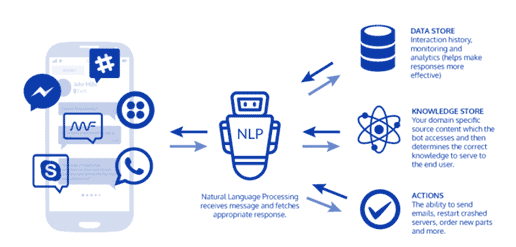

Chatbots are computer programs that use natural language processing (NLP) to understand and respond to customer queries. These bots can handle a large volume of customer inquiries on a 24/7 basis, which reduces the need for human intervention and allows customers to receive responses immediately to any questions they may have and avoid long waiting times on the phone. According to statistics, service representatives save about 4 minutes of their time for every query a chatbot handles, saving up to $0.70 per query (Source 1). Below is a diagram that describes the inputs and outputs of a chatbot using NLP:

2) Personalization of Customers’ Banking Experiences

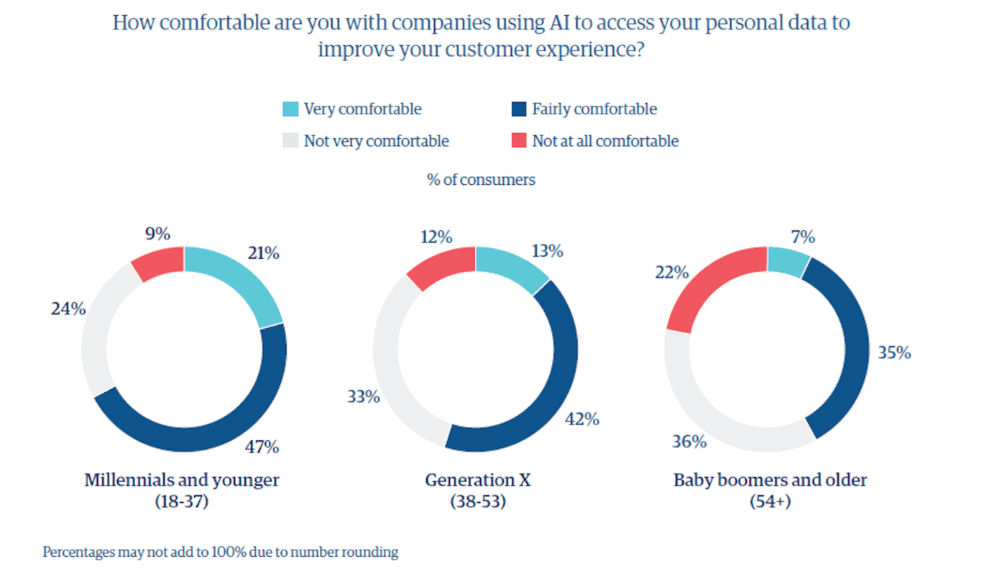

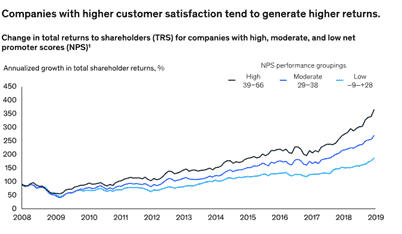

By analyzing customer data, transaction history, and demographics, AI technology, such as chatbots, can provide tailored recommendations, personalized advice, and even financial products relevant to the customer’s specific needs and risk appetite. For instance, if the AI has observed a customer’s spending habits for long enough, it will be able to use real-time tracking to help prevent the adaptation of poor spending habits and alert customers when they reach a specific spending level in their accounts (Source 3). Furthermore, banks can utilize AI to create personalized financial dashboards that give customers a complete view of their financial standing. This includes personalized budgets, savings plans, and investment strategies that are tailored to the customer’s financial goals (Source 4). The below two diagrams capture the level of comfort per age group with companies using AI to access personal data as well as a study indicating that higher customer satisfaction tends to result in higher returns, respectively:

3) Prevention of Fraud

AI can prevent bank fraud by using machine-learning algorithms to analyze customer behavior and transaction data to detect real-time anomalies and suspicious activities. Any unusual behavior by the customer, such as a sudden increase in the number of large sum money transfers to an unknown account, will be picked up by these algorithms and alert the bank’s fraud detection team to investigate and take the necessary measures. As online banking is almost second nature to most customers, AI can also monitor online banking activity and identify fraudulent attempts to access accounts (Source 7). For instance, if an individual tries to access an account from a new location or use an unfamiliar device, the AI will detect this and require the user to take additional security measures, such as two-factor authentication, to ensure they are indeed the correct owner of the account.

4) Voice Assistants

Like Amazon’s Alexa, Apple’s Siri, or Google Assistant, banks can also use voice assistants to provide customers with voice-activated banking services. For example, customers can ask about their account balances, transfer funds, or pay bills by using their voice. Like chatbots, voice assistants use NLP and machine-learning algorithms to better understand customer queries and provide relevant responses (source 8). At the time of the launch of Amazon’s Alexa, Bank of America introduced Erica in 2016, which would closely observe customers’ transactions and analyze their financial patterns (source 9). According to an Ipsos-Forbes Advisor survey, since approximately 8 out of 10 Americans use online banking, it will only be a matter of time until AI technology further improves and customers develop a greater comfort level using digitized customer service technologies, such as voice assistants.

5) Cost Reduction and Resource Optimization

According to IBM, businesses worldwide spend over $1.3 trillion on 265 billion customer service calls each year (source 10). Chatbots can significantly reduce service costs by speeding up response times and answering frequently asked questions, allowing banking agents to focus on more challenging and situational tasks. For instance, a new report by Gartner showed that replacing human agents with AI chatbots could save the call center industry up to $80 billion in labor costs per year by 2026 and $240 billion by 2031 (Source 11). Gartner also estimates the implementation cost to be approximately between $1,000 and $1,500 per conversational AI agent, which is still significantly less than the average cost of hiring a human agent which is around $29,000 per year (Source 12).

Challenges of Implementing AI in the Financial Services Industry

Despite the numerous advantages AI can bring to the banking sector, implementing AI in the financial services industry also poses many challenges, ranging from data quality and privacy concerns to regulatory adherence. A few key challenges are:

1. Data Quality and Availability

For AI to provide accurate predictions and decisions to customers, large amounts of high-quality data are required to train the AI algorithms (Source 13). Banking data can be highly complex and diverse because various data elements are stored in disparate systems. Therefore, ensuring data quality, completeness and accessibility across multiple sources can be a significant challenge.

2. Data Privacy and Security

As banks handle sensitive customer information, including personal and financial data, implementing AI requires careful attention to data privacy and security regulations, such as the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA) (Source 14). Banks must ensure their AI systems adhere to these regulations and protect customer data from unauthorized access or breaches.

3. Regulatory Compliance

While there are heavy regulations in the banking industry to maintain stability, protect consumers, and prevent money laundering and fraud, implementing AI also requires careful consideration of regulatory requirements, such as anti-money laundering (AML) and Know Your Customer (KYC) regulations (Source 15). Similarly, to ensure customer data privacy, financial institutions must ensure their AI systems comply with these regulations and provide audit trails when required.

In conclusion, the role of AI in the banking sector, particularly in improving customer service, is becoming increasingly significant. Banks can leverage machine-learning algorithms, NLP, and other AI technologies to provide customers with personalized, efficient, and 24/7 customer service. This not only increases customer satisfaction but also dramatically reduces operational costs, which will ultimately drive revenue growth in the long run. However, it is important to acknowledge that implementing AI in the financial services industry comes with its own set of challenges. Data quality, privacy concerns, and regulatory compliance must be carefully addressed to ensure accurate predictions, protect customer information, and adhere to industry regulations.

As we look to the future, the evolution of AI promises even more advanced applications that will continue to transform the banking landscape. New developments in AI technology have the potential to offer even greater personalization and efficiency, from more intuitive chatbots to advanced predictive systems that can anticipate customer needs before they arise. However, financial institutions must navigate this new era of AI-powered services with caution, promoting full transparency and ensuring robust protection of customer data and privacy. Institutions must strike a delicate balance between leveraging AI technology for convenience and efficiency while maintaining trust and security in the increasingly digital banking environment. By addressing the challenges of data quality, privacy concerns, and regulatory compliance head-on, banks can harness the full potential of AI to provide exceptional customer service while upholding the highest standards of trust and security.

About Bip.Monticello

Bip.Monticello, a member of the BIP Group, is a management consulting firm supporting the financial services industry through deep knowledge and expertise in digital transformation, change management, and financial services advisory. In partnership with Bip.xTech, we collaborate with our clients to infuse the spirit of data-driven organizations and build digital solutions, helping them make their operations more efficient and achieve a competitive advantage in the marketspace.

Sources

1. https://www.juniperresearch.com/resources/analystxpress/july-2017/chatbot-conversations-to-deliver-8bn-cost-saving

2. https://www.intellectsoft.net/blog/how-to-build-a-chatbot/ (Figure 1)

3. https://www.bedelfinancial.com/how-will-a-i-impact-your-personal-finances

4. https://cointelegraph.com/news/7-potential-use-cases-of-chatbots-in-banking

5. https://www.genpact.com/insight/artificial-intelligence-in-consumer-banking (Figure 2)

6. https://www.mckinsey.com/industries/financial-services/our-insights/reimagining-customer-engagement-for-the-ai-bank-of-the-future (Figure 3)

7. https://sqnbankingsystems.com/blog/artificial-intelligence-in-bank-fraud-detection-and-prevention/

8. https://www.customerservicemanager.com/how-voice-assistants-can-improve-customer-service/

9. https://www.business2community.com/business-innovation/voice-assistants-and-conversational-ai-the-future-of-banking-02051355

10. https://chatbotsmagazine.com/3-practical-applications-of-chatbots-for-customer-service-2bb7073bd2ac

11. https://www.gartner.com/en/newsroom/press-releases/2022-08-31-gartner-predicts-conversational-ai-will-reduce-contac

12. https://techmonitor.ai/technology/ai-and-automation/call-centre-ai

13. https://profinch.com/impact-of-ai-in-banking-opportunities-and-challenges/

14. https://www.retailbankerinternational.com/comment/data-privacy-in-banking-technology-trends/

15. https://www.ardentprivacy.ai/blog/what-are-the-major-security-and-privacy-challenges-in-open-banking/